Fantastic Info About How To Lower Credit Card Limit

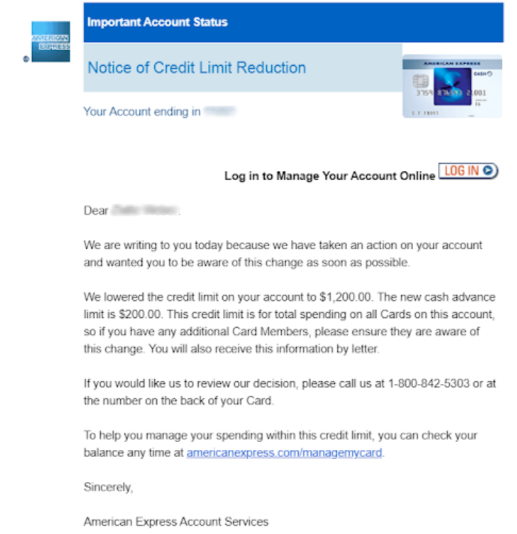

After you logged into your account online, just send a secured message to chase stating you would like to lower your credit limit to $xxx on which card.

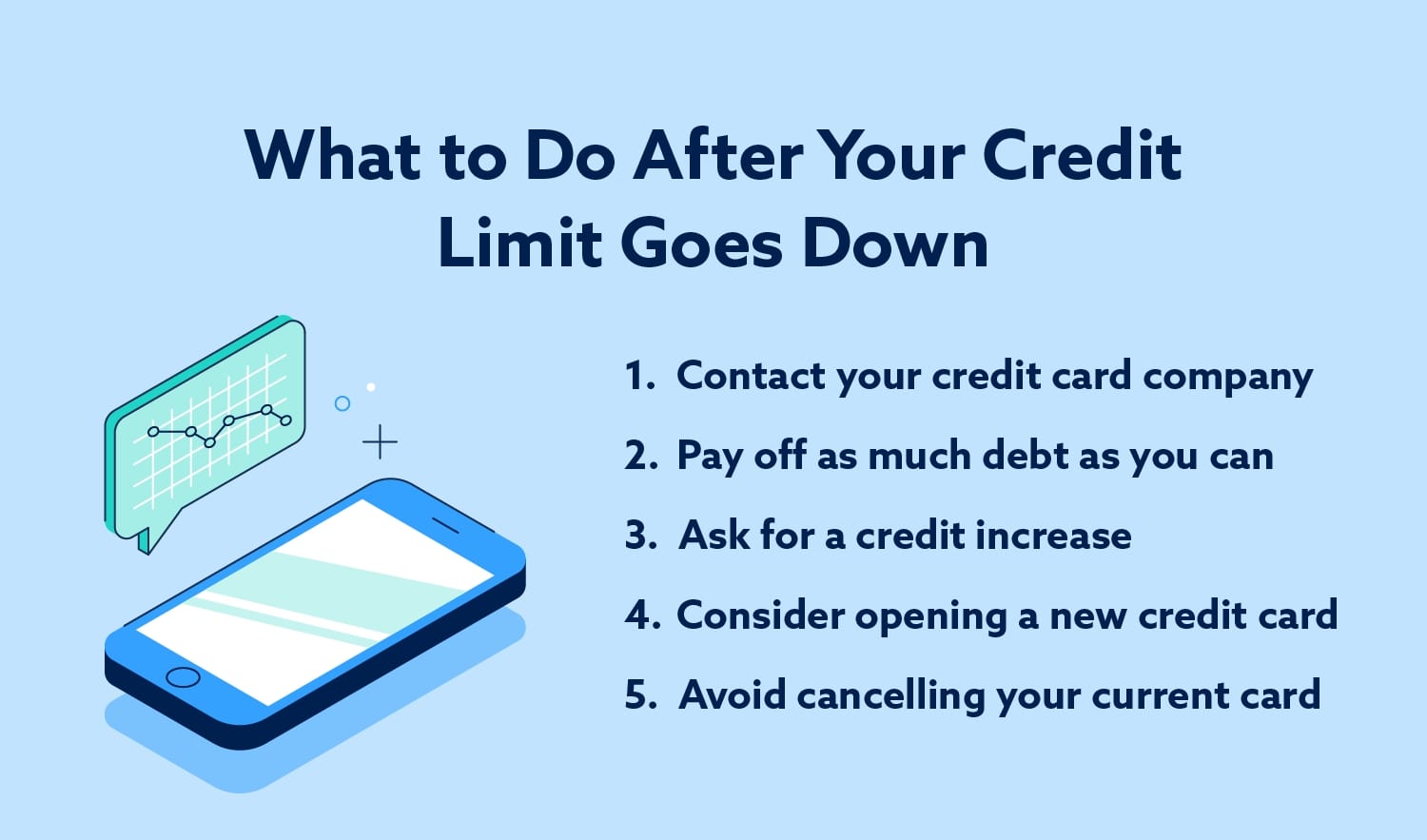

How to lower credit card limit. A lower credit limit can come as a shock. What should i do if this happens? Maintain your credit score the first strategy to keep up.

Here are a few tips: The most obvious reason for this is that reducing your credit limit reduces your spending flexibility. If you have two credit cards with a.

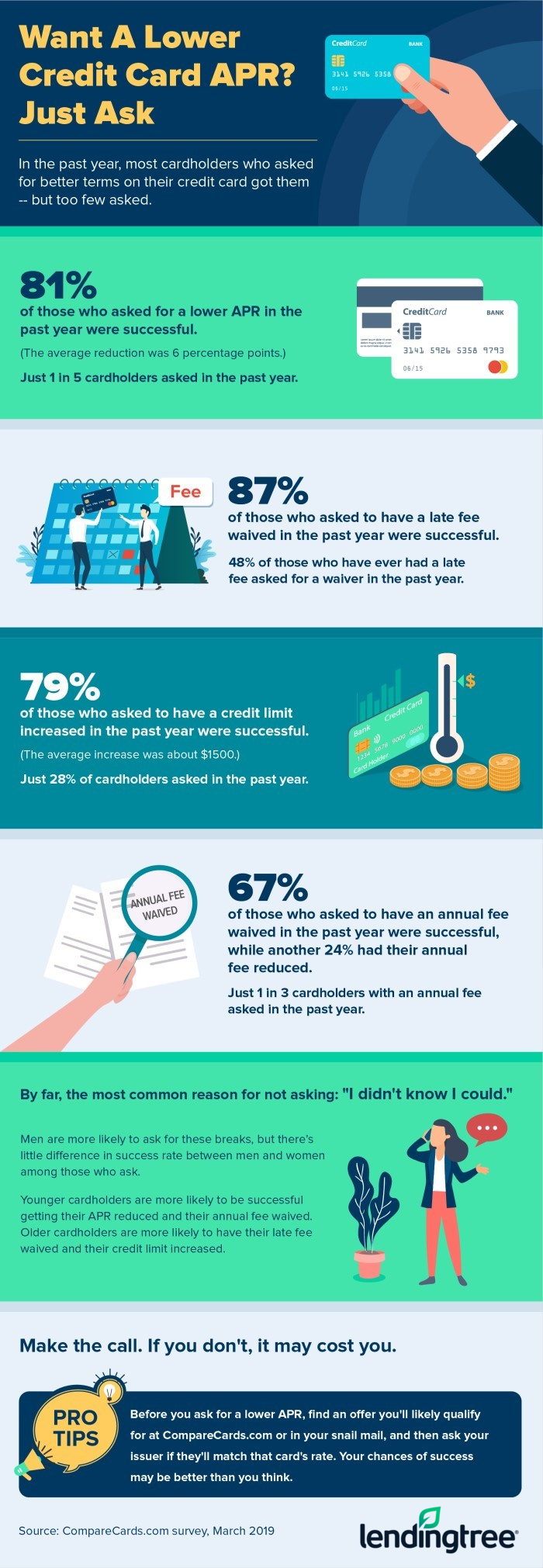

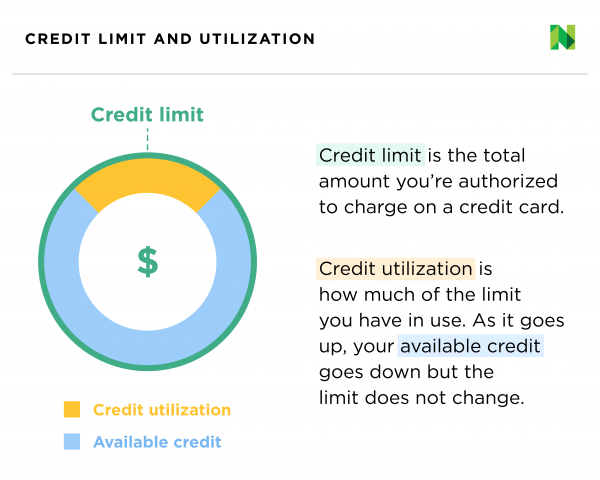

And there's a growing concern that many credit card bills will become past due as borrowers. To be approved, however, you must meet the card issuer’s criteria for the credit card and limit you. A credit limit increase can lower your utilization rate.

Credit card companies may lower your credit limit when your card is inactive or your credit usage seems risky. You can decrease your credit card limit by contacting your credit card issuer, generally by calling the number on the back of your card. Check your credit score and report first before you ask for a credit limit increase, it’s a good idea to check your credit score and credit report.

There's a $75 annual fee for the first year, which increases to $99 thereafter. What you can do to avoid a lower credit card limit there are three strategies you can take to avoid the same fate as me: The average credit card balance for americans is $5,221, according to bankrate.

Call the customer service number on the back of your card. Instead, you can call your current credit card company and ask it to lower your limit to a. They may also cut credit lines when their overall credit.